Professor Cui Xuegang from BNU Business School issued a paper in Journal of Economic Behavior and Organization to reveal the mechanism of salary incentive to stimulate the financial market bubble

Recently, Professor Cui Xuegang's team from BNU Business School published an article in the Journal of Economic Behavior and Organization under the title of "Incentive schemes, framing, and market behaviour: evidence from an asset-market experiment". Journal of Economic Behavior and Organization is a journal in the field of behavioral economics, focusing on economic decision-making, organization and behavior. It aims to help understand how human cognitive, thinking and information characteristics affect the operation of economic organization and market economy, as well as the internal relationship between the evolution of economic system and various micro and macro behaviors.

Since the global financial turmoil in 2008, the impact of pay incentives on the financial market bubble has been highly concerned by regulators in various countries. Many countries have introduced bills or policies to govern the compensation incentive plan of financial enterprises, which has aroused a lot of scholars' interest in research. However, salary incentive can be expressed in many ways, and different incentive schemes produce different incentive effects in different dimensions, which will affect the economic decision-making and financial transaction behavior of incentive objects. The mechanism of compensation incentive and financial market bubble has not been well revealed.

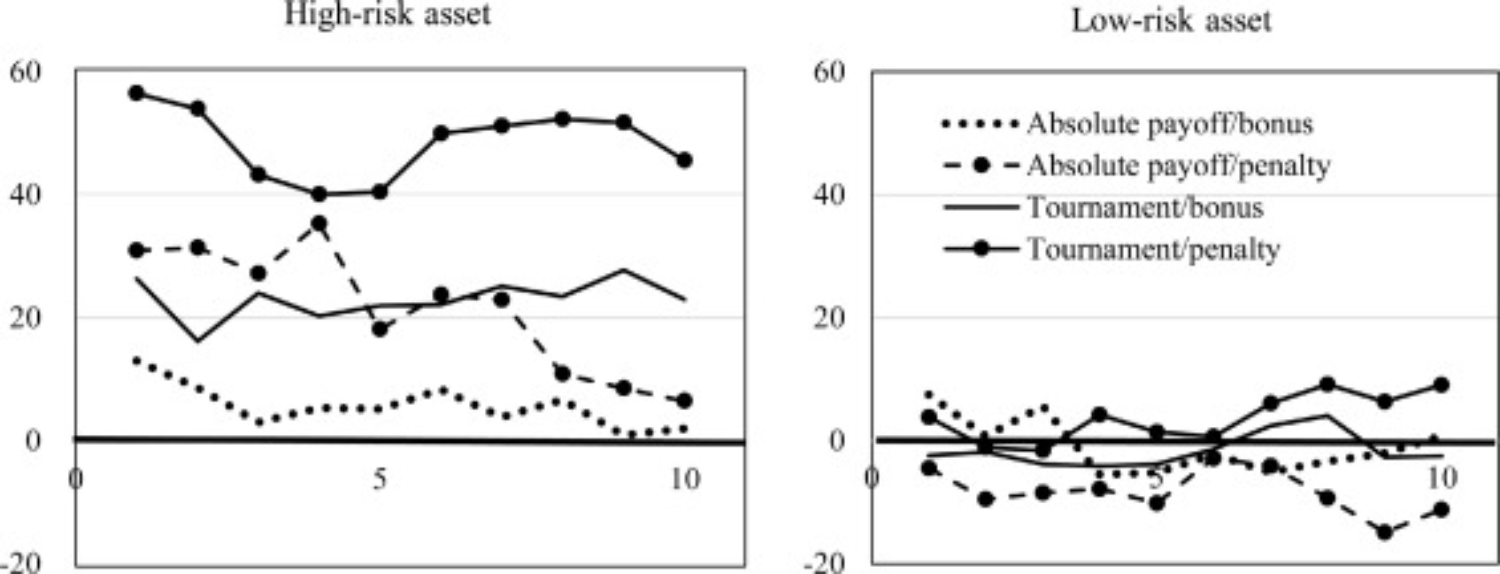

Time series of asset prices (relative deviations from fundamental value), by cell.

This paper constructs a classic financial asset (stock) trading system using a lab experiment, manipulates the two complex factors of incentive framework and tournament mechanism, and studies how the price and trading behavior of financial assets are affected by incentive framework and incentive mechanism by observing the subjects' trading decisions and returns on high-risk assets, low-risk assets and risk-free assets.

The research finds that both manipulations have significant effects. Either moving from a bonus to a penalty frame, or moving from an absolute incentive scheme to a tournament, leads to higher prices for the riskier asset - both in cash and as a premium over the price of the less risky asset - indicating higher demand for risk in these treatments. Thus, even after controlling for the convexity of incentives, tournaments entail increased risky behaviour (versus payment based on absolute performance), as does loss framing (versus gain framing). Additional analysis shows that there is a significant gender difference in financial transactions and transaction results, indicating that gender differences may be related to the mechanism of financial asset bubbles. This paper reveals the mechanism of price bubbles in the financial market from the perspective of salary incentives, and provides important policy implications for the construction of micro regulatory measures to prevent systemic financial risks.

https://www.sciencedirect.com/science/article/pii/S0167268122000890?via=ihub